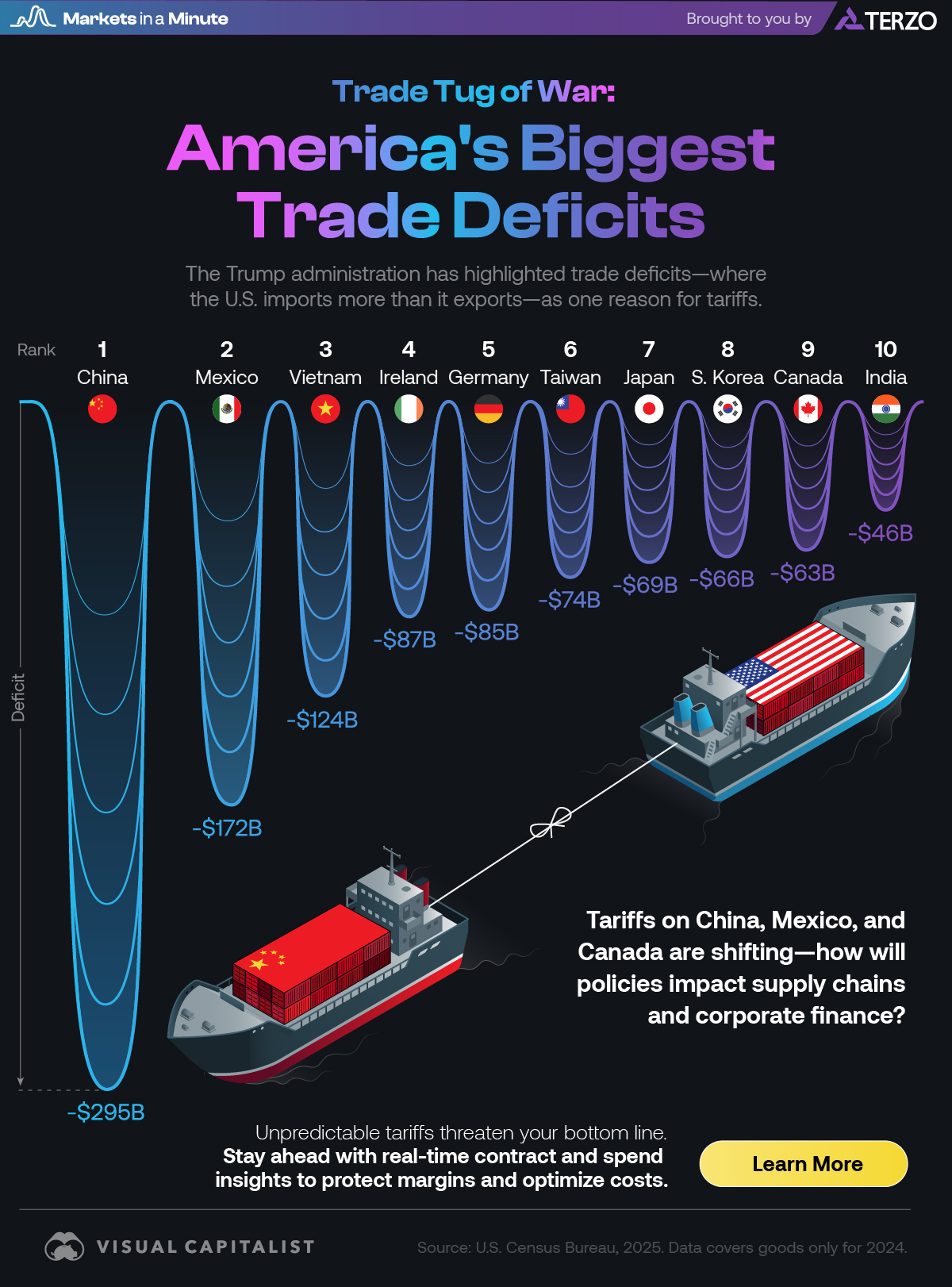

US Liberation Day tariffs have been based on a methodology to repair the damage caused by trade imbalance with certain countries and hence calibration of rates has been based on this formula - US trade deicit with EU countries is $200 bn and with China $300 bn and they are the main countries under attack

The real story behind US Prez Trumps reciprocal tariffs across the Globe on 180 countries including 60 worst offenders alleged to be feeding off American economy – India to be a major benificiary of Trump tariffs as it kicks of a major manufacturing boom.

BY TN Ashok New York, April 05, 2025

Has US President Donald Trump made an oversimplified calculation in imposing the stiff tariff rates on 180 countries including 60 offending ones – steepest being 54% on China with which it has massive trade deficit and EU countries – while he let off countries like UK and India , strong allies , with mild tariffs, UK is still negotiating .

Trade deficits with countries seems to the “ mool mantra’ behind the calibration of tariffs for each country – the higher the trade deficit and the higher the tariffs. With EU countries , US rurns a trade deficit of over $200 billion and hence tariffs with that group is about 20% but EU hasxslapped 39% tariffs on US and considering further.

With China its largest trading partner, US runs a trade deficit of over $300 billion and hence the highhest tariff , which is 54% (34%+20%). India has escaped with 27% tariff but its still high considering that it has only 2.7% of the global trade with the US.

China has near 14% of the global trade with US and EU countries near 13% of the global trade with America and they both enjoy trade deficits with US which works to their advantage. So the new tariffs seem to correct this trade imbalance, point out analysts

India could become a major manufacuting center for US under these tariffs, analysts said. Because the high tariffs imposed on China and Bangladesh and Taiwan opens up newer and bigger markets for Indian goods in the US. India enjoys only 27% tariffs whereas others like China, Vietnam, Bangladesh and Taiwan, Indias competitors in grains, garments and semi conductors, ends up being a beneficiary as american manufacturers would like to beat higher import costs by sourcing their products to India. Expect a huge production boom , courtesy Trump for India and his buddy PM Modi.

Meanwhile, the blackboard of tariffs showing the comparison between US tariffs and each countries tariffs on the US are being dubbed as reciprocal tariffs – that is matching tariffs that other countries charge the US. But the methodology behind Trump’s attempt to rebalance trade has nothing to do with the tariff rate that foreign countries impose on the US, observes a columnist from the CNN in an analysis that studies the rationale and logic behind the steep tariffs.

The Trump administration has used a grossly oversimplified calculation that it said factored in a broad set of issues such as Chinese investment, alleged currency manipulation and other countries’ regulations. The administration’s calculation divided a country’s trade deficit with the US by its exports into the country times 1/2. That’s it.

The president is essentially taking a sledgehammer to address a litany of grievances, using the trade deficit that other countries have with the US as a scapegoat. And the vague calculation could have broad implications for countries America depends on for goods — and the foreign companies that supply them, the CNN analysis pointed out.

“There does not appear to have been any tariffs used in the calculation of the rate,” said Mike O’Rourke, chief marketing strategist at Jones Trading, in a note to investors Wednesday. “The Trump administration is specifically targeting nations with large trade surpluses with the United States relative to their exports to the United States.”

The actual figures are probably closer to the “average Most-Favored-Nation (MFN) applied tariff rate,” which is essentially a ceiling of import taxes that more than 160 nations of the World Trade Organization have agreed to charge each other, though they can vary by sector. And for countries with trade agreements in place, there could be lower or no tariffs at all.

Trump has frequently said his trade policy is rooted in one simple motto: “They charge us, we charge them.” It turns out it’s not that simple.

“A lot of the issues that the administration highlighted, that they’re concerned about, are not really with tariff rates,” Sarah Bianchi, chief strategist of international political affairs and public policy at Evercore ISI, said Thursday during a panel discussion hosted by the Brookings Institution.

Trump’s so-called answer to non-trade barriers

The MFN tariff rates were born out of negotiations among WTO members in the 1990s, when the organization was first founded. The European Union’s MFN rate is 5%, but the Trump administration said it’s more like 20% because “US exports suffer from the uneven and inconsistent” customs rules across the currency zone and because “EU-level institutions do not provide transparency in decision-making,” the US Trade Representative’s office said.

Meanwhile, Vietnam’s MFN tariff rate is 9.4%, as of the latest data from 2023, but the Trump administration chalked it up to 46% because of non-trade barriers, according to a report from the USTR’s office released this week. Non-trade barriers can include import quotas and anti-dumping laws that are aimed at protecting domestic industries.

Vietnam’s top trade official on Thursday called Trump’s new tariff on the country “unfair,” pointing to the MFN rate.

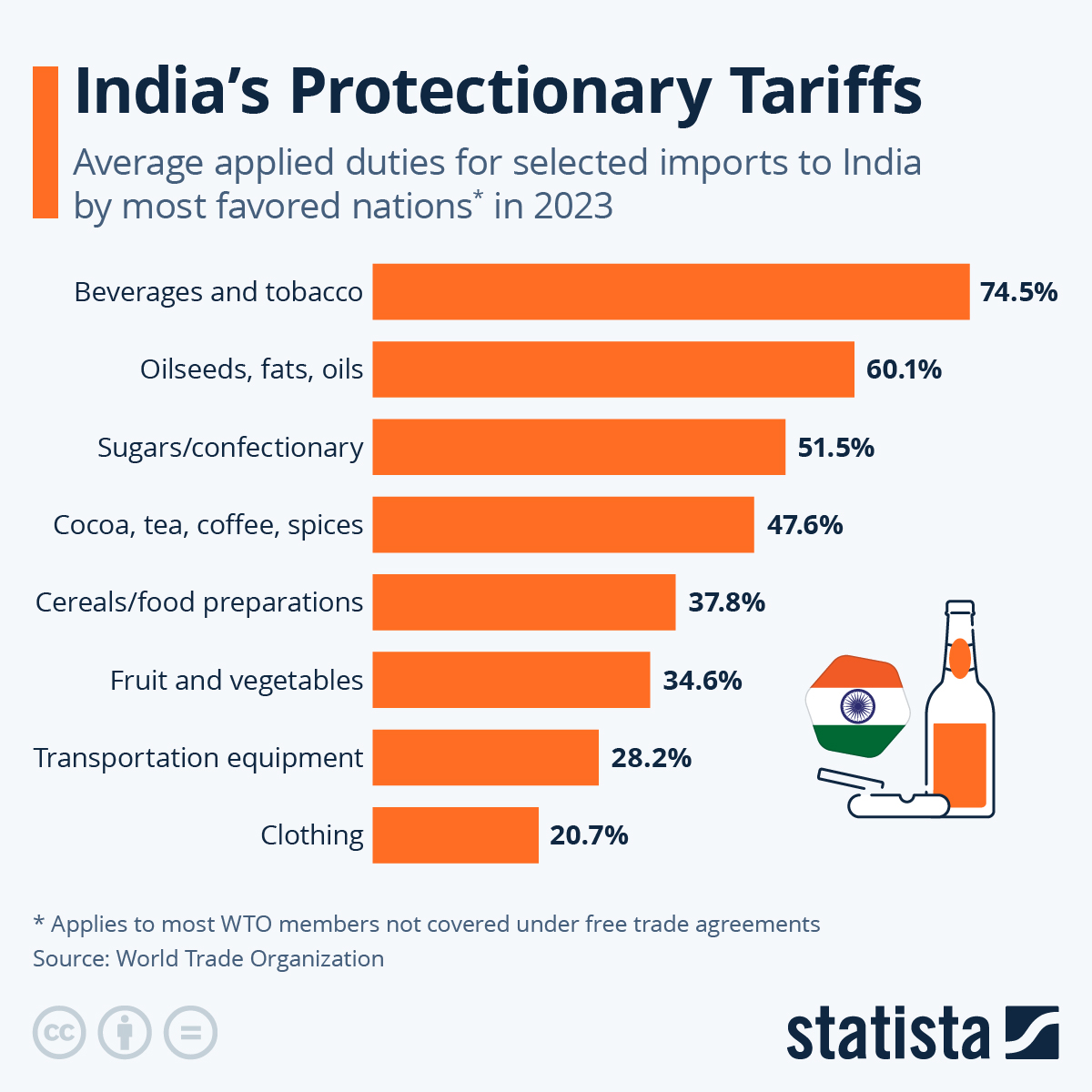

India and China also have some non-trade barriers, noted Sung Won Sohn, professor of finance and economics at Loyola Marymount University and chief economist at SS Economics. For example, India has sanitary measures for agricultural imports and China has state subsidies favoring domestic companies, he wrote in commentary issued earlier this year.

But “Liberation Day” was still not the right approach to addressing non-tariff measures from other countries, said Joe Brusuelas, chief economist at markets insight firm RSM, told CNN in an interview.

“If you look at the formula the White House put forward for how they established the new tariff levels, they had nothing to do with non-tariff barriers,” he said, adding: “It looked to me as if it was an ad hoc effort of punishing countries because they had large trade balances with the United States.”

That bilateral trade balance the US runs with other countries, he said, is “simply a function of saving and spending in the United States.”

Trade deficits aren’t an emergency

A senior White House official referred to the deficits as a national emergency that must be addressed to retain factories and jobs in the US. But is it a terrible thing that countries run such deficits with the US? Not necessarily.

Many countries run a trade deficit with the US, according to trade data. The United States runs $230 billion more in imports than exports to the EU, and nearly $300 billion more to China.

“When I go to the store and buy groceries with cash, I run a trade deficit with my grocery store, but does that mean that I’m worse off? Obviously not,” John Dove, an economics professor at Troy University said. “Those are goods that I want, and I don’t need to provide a reciprocal good or service in return. That’s not necessarily a good or a bad thing. It just is.”

Still, the Trump administration has pointed to tariffs aimed at fixing trade deficits as a potential source of government revenue to pay down the national debt and fund tax cuts. But that’s a risky gamble that could prove disastrous if countries band together to retaliate.

“The more concerning issue is that these large across-the-board tariffs incentivize our trading partners to retaliate against us,” Dove said.

If other countries renegotiate their own trade policies, the US “could very quickly end up in a situation where you have 25% of the world economy up against the other 75%,” he said, “and I can tell you who’s going to come out ahead there.”

Trump's sweeping global tariffs will quite likely spark a manufacturing boom in India

How Trump's tariffs may impact India

Donald Trump's sweeping tariffs have shaken global trade, but disruption often creates opportunity. Out of Chaos comes Order right, the biblical saying.

Starting 9 April, Indian goods will face tariffs of up to 27% (Trump's tariff chart lists India's rate as 26%, but the official order says 27% - a discrepancy seen for other nations too). Before the tariff hike, US rates across trading partners averaged 3.3%, among the lowest globally, compared to India's 17%, according to the White House.

However, with the US imposing even higher tariffs on China (54%), Vietnam (46%), Thailand (36%) and Bangladesh (37%), India "presents an opportunity" in textiles, electronics and machinery, according to the Delhi-based think tank Global Trade Research Initiative (GTRI).

High tariffs on Chinese and Bangladeshi exports open space for Indian textile manufacturers to expand in the US market. While Taiwan leads in semiconductors, India can tap into packaging, testing and lower-end chip manufacturing - if it strengthens infrastructure and policy support. Even a partial supply chain shift from Taiwan, driven by 32% tariffs, could work in India's favour, BBC says in an analytical report.

Can India seize the moment offered to it on a Golden Platter by its staunch ally and friend President Donald Trump.

High tariffs increase costs for companies dependent on global value and supply chains, hobbling India's ability to compete in international markets. Despite growing exports - primarily driven by services - India runs a significant trade deficit. India's share of global exports is a mere 1.5%. Trump has repeatedly branded India a "tariff king" and a "big abuser" of trade ties. With his new tariffs, the fear is that Indian exports will be less competitive.

"Overall, the US's protectionist tariff regime could act as a catalyst for India to gain from global supply chain realignments," says Ajay Srivastava of GTRI. "However, to fully leverage these opportunities, India must enhance its ease of doing business, invest in logistics and infrastructure and maintain policy stability. If these conditions are met, India is well-positioned to become a key global manufacturing and export hub in the coming years."

That's easier said than done. Biswajit Dhar, a trade expert from the Delhi-based Council for Social Development think tank, points out that countries like Malaysia and Indonesia are possibly better positioned than India. "We may regain some lost ground in garments now that Bangladesh faces higher tariffs, but the reality is we've treated garments as a sunset sector and failed to invest. Without building capacity, how can we truly benefit from these tariff shifts?"asks Mr Dhar.

Since February, India has ramped up efforts to win Trump's favor - pledging $25bn in US energy imports, courting Washington as a top defense supplier and exploring F-35 fighter deals. To ease trade tensions, it scrapped the 6% digital ad tax, cut bourbon whiskey tariffs to 100% from 150% and slashed duties on luxury cars and solar cells. Meanwhile, Elon Musk's Starlink nears final approval. The two countries have launched extensive trade talks to narrow the US's $45bn trade deficit with India.

Yet, India did not escape the tariff war.

"India should be concerned - there was hope that ongoing trade negotiations would shield it from reciprocal tariffs. Facing these tariffs now is a serious setback," says Abhijit Das, former head of the Centre for WTO Studies at the Indian Institute of Foreign Trade.

Exports in key sectors like electronics and engineering goods could take a hit from the new tariff plan.

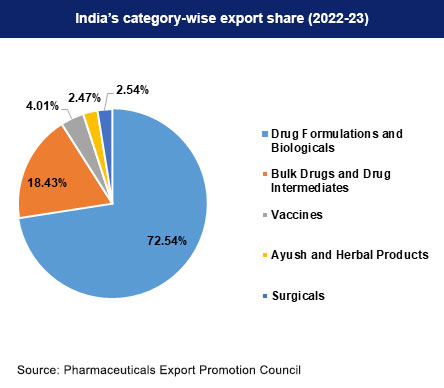

However , One upside: pharmaceuticals are exempt from reciprocal tariffs, a relief for India's generic drug makers. India supplies nearly half of all generic medicines in the US, where these lower-cost alternatives account for 90% of prescriptions.

However, exports in key sectors like electronics, engineering goods - automobile parts, industrial machines - and marine products could take a hit. It would be especially troubling for electronics, given the heavy investments through India's flagship "production-linked incentives" (PLI) schemes to boost local manufacturing.

However, exports in key sectors like electronics, engineering goods - automobile parts, industrial machines - and marine products could take a hit. It would be especially troubling for electronics, given the heavy investments through India's flagship "production-linked incentives" (PLI) schemes to boost local manufacturing.

"I'm apprehensive about our exporters' capacity - many are small manufacturers who will struggle to absorb a 27% tariff hike, making them uncompetitive. High logistical costs, rising business expenses and deteriorating trade infrastructure only add to the challenge. We're starting at a major disadvantage," says Mr Dhar.

Many see these tariffs as Trump's bargaining chip in trade negotiations with India. The latest US Trade Representative report underscores Washington's frustration with India's trade policies.

A report released by the office of the US Trade Office released Monday, red flags India's strict import rules on dairy, pork and fish, requiring non-GMO certification without scientific backing. It also criticizes India's sluggish approval process for genetically modified products and price caps on stents and implants.

Intellectual property concerns have landed India on the 'Priority Watch List', for which the report cites weak patent protections and a lack of trade secret laws. The report also frets about data localization mandates and restrictive satellite policies, straining trade ties further. Washington fears India's regulatory approach is increasingly mirroring China's. If these barriers were removed, US exports could rise by at least $5.3bn annually, according to the White House.

"The timing couldn't be worse - being in the middle of trade negotiations only deepens our disadvantage. This isn't just about market access; it's the whole package," says Mr Dhar. Also, gaining an edge over Vietnam or China won't happen overnight - building opportunities and competitive strength takes time.

Cargo containers line a shipping terminal at the port of Oakland in California on Friday. Photograph: Courtesy - AP

Trump tariffs come into effect in ‘seismic’ shift to global trade, say global trade analysts. The ‘Baseline’ 10% import levy takes effect at US seaports, airports and customs warehouses on Saturday, with some higher tariffs to begin next week

Donald Trump’s 10% tariff on all imports from many countries, including the UK, has come into force after 48 hours of turmoil.

US customs agents began collecting the unilateral tariff at US seaports, airports and customs warehouses at 12.01am ET (04:01 GMT), with higher levies on goods from 57 larger trading partners due to start next week – including from the EU, which will be hit with a 20% rate.

Keir Starmer was expected to spend the weekend speaking to foreign leaders about the tariffs, after calls with the Australian prime minister, Anthony Albanese, and the Italian PM, Giorgia Meloni, on Friday in which the leaders agreed that an “all-out trade war would be extremely damaging”.

Starmer was “clear the UK’s response will be guided by the national interest” and officials would “calmly continue with our preparatory work, rather than rush to retaliate”, a No 10 spokesperson said.

Up until now, UK ministers have avoided voicing any criticism of Trump as they sought to secure a trade agreement with the US – hoping for some exemption from the tariffs. However, the UK government has drawn up a list of products that could be hit in retaliation, and was consulting with businesses on how any countermeasures could affect them.

Ralph Goodale, the high commissioner for Canada in the UK, told BBC’s Radio 4 Today programme that the US needed to “feel the pain” and Canada would stand firm.

He said: “The action taken by the US government is completely illogical. It will damage the United States itself. It will raise costs in the United States. It will eliminate jobs in the United States, it will reduce growth in the United States and we have to make it abundantly clear not just that that is going to happen rhetorically, but the US has to feel the pain, because ultimately it will be Americans who will persuade their government to stop this foolishness.”

Trump’s announcement of the tariffs on Wednesday shook global stock markets to their core, wiping out $5tn in stock market value for S&P 500 companies by Friday’s close, a record two-day decline. The prices of oil and commodities plunged, as investors fled to the safety of government bonds.

“This is the single biggest trade action of our lifetime,” said Kelly Ann Shaw, a trade lawyer at Hogan Lovells and former White House trade adviser during Trump’s first term. ‘In economic terms, Trump’s tariffs make no sense at all’

While speaking at a Brookings Institution event on Thursday, Shaw said she expected that over time the tariffs would evolve as countries started negotiating lower rates for themselves, but she called the change “huge”.

Shaw said: “This is a pretty seismic and significant shift in the way that we trade with every country on Earth.”

Australia, the UK, Colombia, Argentina, Egypt and Saudi Arabia are among countries initially hit with the 10% tariff.

At 12.01 ET on Wednesday, Trump’s higher “reciprocal” tariff rates of 11% to 50% are due to take effect. EU imports will face a 20% tariff, while Chinese goods will be hit with a 34% tariff, bringing Trump’s total new levies on China to 54%.

Canada and Mexico were exempt from Trump’s latest duties because they are still subject to a 25% tariff related to the US fentanyl crisis for goods that do not comply with the US-Mexico-Canada rules of origin.

Source: CNN, BBC, Reuters and other major international news networks.

Comments

Post a Comment