US President Trumps' attempts to legalise crypto currency through his sons venture World Liberty FinancIal and Abu Dhabi based Binance invites scorn and skepticism besides utter condemnation for removing the financial dealings from government control

Crypto currency and its future in America under the Trump administration – Are Americans buying it? What's the percentage of the populations that feels secure in investing in crypto currency considering it gives big returns.

By Ashe Neil New York, May 31, 2025

Former US President Joe Biden considered regulating crypto currency just like many levelheaded presidents and prime ministers of other countries. Because US intelligence reports revealed that the crypto currency was largely used by the underworld to stash money earned by beating the law and it kept moving across the globe and had no regulatory authority to track it.

He also considered introducing a Bit Coin through the Federal Reserve where there was accountability in terms of the source of income going into Bit Coin and it came under the government’s regulatory measures. India too considered introducing a Bit Coin through its Federal Reserve, namely the Reserve Bank of India so that source of income is known for tax purposes, and its movement was kept a track of.

The entire idea of introducing official crypto currency was to ensure that genuine investors monies parked in the Bit Coin was diverted back to official channels and their monies were protected and it was not nixed with the monies moved by the underworlds such as drug cartels of Mexico, crime lords of new York and Chicago, and blood money from Africa.

Before Biden could move into the matter with Fed Reserve Chairman Jerome Powell, he went out of power ceding presidential powers and authority to a businessman cum politician Donald Trump who thinks out of the box (the Wrong Way) and uses non bureaucratic methods to implement his policies.

So, the world of crypto currency has got a new lease of life, thanks to Trump, who has launched his own company through his family members, called the World Liberty Financial.

The world of crypto currency is strange. Ever since its introduction, probably a decade ago, it was launched with a $1 price tag which soared to $1,000 and now is a whopping $100,000. It's fantastic place to invest without being monitored by the government and having to pay taxes when you double, treble, quadruple your investments.

Crypto currencies use a tool or methodology for storing virtual money in an ingenious way – the block chain technology. Money is stored virtually in a black box which you can recall any time, anywhere in the world through codes provided to you by the masterminds of the block chain who manage your currency.

| Trump family | |

|---|---|

| Current region | New York City, New York / Palm Beach, Florida, U.S. |

|---|---|

| Place of origin | Kallstadt, Germany |

| Founder | Frederick Trump |

| Titles | List |

| Members | Fred Trump Maryanne Trump Barry Fred Trump Jr. Donald Trump Robert S. Trump Donald Trump Jr. Eric Trump Ivanka Trump Tiffany Trump Barron Trump Kai Trump |

| Connected members | Elizabeth Christ Trump Mary Anne Trump Melania Trump Ivana Trump Marla Maples Vanessa Trump Jared Kushner Lara Trump Michael Boulos |

| Connected families | Clan MacLeod Kushner family |

| ||

|---|---|---|

The problem with crypto currency is that it exploded into tens and thousands of different variants of the Bit Coin, I shall list them separately in another analysis.

Bit Coins are becoming famous in India where a lot of income is generated my mafia dons, film stars and corrupt politicians who park their illegal incomes in crypto currency which is not monitored by the government.

Even famous movie stars like Amitabh Bachchan openly admitted in a TV interview that he invested his monies in crypto currency which quadrupled his money, and he went on to say you can also do it. The interview was withdrawn by the channel as it kicked up not just a controversy but a storm in the financial world which was largely regulated by the Reserve Bank of India at a time when the Modi government was planning to introduce an official version of its own crypto currency where investors monies were tracked, secured and avoided being mixed with shady dealers parking monies there.

Let's focus on America, the biggest crypto currency market in the world. What has Trump done? Let's start with the latest development.

Trump's crypto complicates Las Vegas wedding between MAGA and bitcoin

:max_bytes(150000):strip_icc()/TermDefinitions_crypto_final-940e93a6cb5341999a5d735fbf04fbfe.png)

Trump was the promoter of the the Bitcoin 2025 conference in Las Vegas where participants questioned the effects of Trump’s meme coin. The meme coin had no links to the president himself per se but to his son Eric Trump, Don Trump jr manaing a company called the World Liberty Financial.

At LAS VEGAS, the biggest official gambling den of the world, bitcoin’ staged its biggest event of the year, the Trump administration was omnipresent. Vice President JD Vance was the keynote speaker at the Bitcoin 2025 conference Wednesday, President Donald Trump’s sons Eric and Donald Jr. appeared on multiple panels, and a delegation of White House advisers including crypto czar David Sacks praised crypto as the future of technology.

The crypto community is used to being treated with skepticism and scorn from many politicians and lawmakers. But a warm embrace from the Trump White House still hasn’t erased some crypto investors’ skepticism, many US publications noted.

Trump has been loosening government oversight and regulations around cryptocurrency; he has also waded into his own crypto project: the $TRUMP coin. Earlier in May, Trump hosted a private dinner at his Washington, D.C.-area golf club for top $TRUMP coin buyers, who on average spent more than $1 million per seat and sparked widespread concern about opportunities for influence-buying.

Trade Now

‘Roadmap for corruption’: Trump’s dive into cryptocurrency raised alarm

over ethical financial dealings. The president’s hawking of $Trump memecoin has sparked a firestorm of criticism over potential influence buying.

Donald Trump’s push to sharply ease oversight of the cryptocurrency industry, while he and his sons have fast expanded crypto ventures that have reaped billions of dollars from investors including foreign ones, is raising alarm about ethical and legal issues.

Watchdog groups, congressional Democrats and some Republicans have levelled a firestorm of criticism at Trump for hawking his own meme coin, $Trump, a novelty crypto token with no inherent value, by personally hosting a 22 May dinner at his Virginia golf club for the 220 largest buyers of $Trump and a private “reception” for the 25 biggest buyers.

TRUMP

2.48% (1d)

To attend the two events, the $Trump buyers spent about $148m, which will benefit Trump and partners, according to the crypto firm Inca Digital.

Further, the Trump family crypto venture World Liberty Financial that launched last fall, which his two oldest sons have promoted hard, was tapped this month to play a key part in a $2bn investment deal by an Abu Dhabi financial fund in the crypto exchange Binance, which in 2023 pleaded guilty to US money laundering and other violations. r While there are no readily available photos of Trump himself promoting Bitcoin in Dubai, here's a breakdown of Trump family connections to cryptocurrency and Dubai:

- World Liberty Financial (WLF): The Trump family has launched a cryptocurrency venture called World Liberty Financial, which aims to offer crypto-based financial services.

- USD1 Stablecoin: WLF created a stablecoin, USD1, pegged to the US dollar.

- Eric Trump's Role: Eric Trump, the former president's son, has been actively involved in promoting the family's crypto business and has spoken at crypto conferences.

- Trump Tower Dubai: The Trump Organization is developing Trump Tower Dubai, a luxury hotel and residential tower.

- Cryptocurrency Payments: Bitcoin and other cryptocurrencies are being accepted as payment for property purchases in Trump Tower Dubai, marking a first for a Trump International Hotel in the Middle East.

- Conflicts of Interest: Trump's business interests in the UAE and his family's involvement in cryptocurrency have raised concerns about potential conflicts of interest, particularly regarding foreign influence and ethical implications.

- Foreign Investment: The Trump family's crypto venture has received investments from Abu Dhabi, further intertwining the family's business with foreign governments.

- Trump's Rhetoric: Trump has expressed positive views on cryptocurrency and has been perceived as supportive of the industry, leading some to expect him to be involved in crypto promotion.

- Dubai's Crypto Hub Status: Dubai has become a hub for cryptocurrency and blockchain technology, making it a potential location for crypto-related events and promotions.

- Confluence of Interests: The combination of Trump's pro-crypto stance, his family's business interests in Dubai, and Dubai's status as a crypto hub might lead some to expect photos of him promoting Bitcoin in the region.

Trump fThe familylys growing involvement in the crypto space and their business ties to Dubai suggest that such events or endorsements might occur in the future.

Trump fThe familylys growing involvement in the crypto space and their business ties to Dubai suggest that such events or endorsements might occur in the future.

The new WLF deal was announced at an Abu Dhabi crypto conference that drew Eric Trump two weeks before Trump’s mid-May visit to the United Arab Emirates capital, sparking other concerns of improper foreign influence and ethics issues.

Trump’s ardent pursuit of crypto fortunes was highlighted in a report last month from the watchdog group State Democracy Defenders Fund that estimated his crypto ventures as of mid-March to be worth about $2.9bn. That is a striking sum since Trump’s crypto ventures are less than a year old.

Senate Democrats led by Jeff Merkley of Oregon and the minority leader, Chuck Schumer of New York, introduced a bill this month that has garnered sizable Democratic backing to block Trump from using his office to benefit his crypto businesses.

Watchdogs say Trump is exploiting his office for personal gain in unprecedented and dangerous ways.

Eric Trump, the executive vice-president of the Trump Organization (right) speaks with the co-founder of World Liberty Financial, Zach Witkoff, (centre) and founder of Tron, Justin Sun, during a crypto event in Dubai on 1 May. Photograph: Courtesy AP

“There is the appearance if not the reality of corruption in the upcoming dinner with Trump on the 22nd at his Virginia golf club for the 220 biggest Trump meme coin buyers and the private reception he’s promised for the top 25 buyers, plus the separate $2bn deal between World Liberty Financial and the Abu Dhabi investment vehicle,” said Richard Painter, a former White House ethics adviser to George W Bush who co-authored the Democracy Defenders Fund report.

Other experts are equally troubled by Trump’s manifest conflicts.

“Trump is marketing access to himself as a way to profit his meme coin,” said the Columbia Law professor Richard Briffault, an expert on government ethics.

“People are paying to meet Trump and he’s the regulator in chief. It’s doubly corrupt. This is unprecedented. I don’t think there’s been anything like this in American history.” Briffault pointed out.

Such concerns were fueled when Trump quickly chose crypto industry allies to run the Securities and Exchange Commission and as his “czar” for crypto and AI. Among other moves, the SEC has dropped or put on hold investigations and prosecutions of over a dozen crypto firms.

This is unprecedented. I don’t think there’s been anything like this in American history, Professor Richard Briffault said.

Fears of possible corruption have also focused on Chinese-born Justin Sun, the biggest investor in Trump’s crypto ventures. Sun bought about $20m of $Trump to become its top purchaser before the dinner on the 22nd which he attended. Sun previously invested at least $75m in World Liberty Financial to become its lead investor and an adviser.

Sun may also be benefiting from the SEC’s laxer oversight. Sun was sued by the SEC in 2023 for fraudulent market manipulation and other allegations of misconduct involving three other crypto enterprises of his, including the Tron Foundation.

As the SEC eased its crypto oversight, the agency earlier this year paused its case against Sun, sparking concerns that Trump’s financial ties to Sun might have influenced the agency’s decision, a matter that Senator Elizabeth Warren of Massachusetts and the Democratic congresswoman Maxine Waters of California raised in a letter to the SEC last month, The NBC said in a report.

The SEC allegedly has been holding talks with Sun about settling the charges, and the agency’s chairman told a congressional hearing on 20 May that he knew nothing about Sun’s case.

Other warnings about Trump’s crypto dealings have also been fueled by recent scandals that have plagued crypto businesses, many of which are known for their opaque operations and some illicit dealings including ones tied to North Korean hackers that helped fund the country’s nuclear and military programs, reports say.

Crypto critics were taken aback by a justice department memo in April that closed or packed up a national cryptocurrency enforcement team that was established in 2022, which had brought some major crypto cases against North Korean hackers and other crypto criminals.

The memo stressed the justice department was not a “digital assets regulator” and in a political twist lambasted the Biden administration for its “reckless strategy of regulation by prosecution”. The memo noted that a January pro-crypto Trump executive order spurred its decision.

For their part, Trump, his family and White House press statements have dismissed concerns about conflicts of interest or ethical improprieties with Trump promoting his crypto business while in office.

Demonstrators protest near Trump National Golf Club before the arrival of Donald Trump in Sterling, Virginia, on Thursday. Photograph: Courtesy AP

White House press secretary, Karoline Leavitt, told reporters before the dinner that Trump was attending it in his “personal time” and it was not a White House event, but declined to release names of the attenders.

The Trump Organization in January said that the president’s business interests including his assets and investments, would be placed in a trust that his children would manage and that Trump would not get involved in decision-making or daily operations.

Trump’s family also tapped a lawyer to serve as an ethics adviser.

Those pledges have been overshadowed by Trump’s enthusiasm for his digital currencies. In a harbinger of Trump’s two crypto events on the 22nd, in March he hosted the first-ever White House “crypto summit” for a couple of dozen industry leaders where he pledged to end the Biden administration’s “war on crypto”.

“Trump’s crypto schemes are profoundly corrupt,” Merkley told the Guardian. “He’s selling access to his administration and enriching himself in the process.”

In response, Merkley and Schumer introduced the End Crypto Corruption Act, which 20 other Democrats have endorsed.

Merkley stressed that the bill would “not only crack down on this alleged corruption but also prevent other officials – like members of Congress and Trump’s billionaire sidekick Elon Musk – from betraying public trust”.

Merkley’s warnings are now being echoed by several watchdogs.

“Trump’s dealings in crypto appear to present the greatest conflicts of interest and avenues for corruption any president has ever embraced,” said Larry Noble, a former general counsel at the Federal Election Commission who now teaches law at American University.

Noble’s alarms are underscored by the large number of foreign buyers who appear to have scooped up Trump’s meme coin to win coveted spots at his dinner.

While the identities of most $Trump purchasers are unknown, several reports from crypto analysts who track the industry suggest that a large number of foreign buyers have ponied up tens of millions of dollars to buy $Trump coins and attend the dinner.

One analysis by Bloomberg has indicated that 19 of the top 25 crypto wallets are almost definitely owned by individuals who operate outside the US.

Sun, who bought $4.5m of his almost $20m in $Trump coins after Trump announced the events on the 22nd, showed his appreciation by posting on X on 19 May: “Honored to support @POTUS and grateful for the invitation from @GetTrumpMemes to attend President Trump’s Gala Dinner as his TOP fan!”

Besides Sun, the second biggest buyer is reportedly Meme Core, a Singapore-based crypto network that was vocal about its interest in attending the Trump dinner and invested $18m.

Trump’s avid embrace of crypto became palpable last summer at a bitcoin conference where he pledged to make the US the “crypto capital of the world”, a marked shift from 2021 when he dismissed bitcoin as a “scam”. The change helped his campaign pull in millions of dollars in crypto industry donations.

Last fall, Trump and his two older sons, Eric and Don Jr, announced on the multibillionaire Elon Musk’s X that they were launching World Liberty Financial.

Trump on X boasted opaquely that “crypto is one of those things we have to do. Whether we like it or not, I have to do it.” A white paper for the new business dubbed Trump “its chief crypto advocate”, and his sons have promoted it aggressively and helped to lure new investments.

Trump on X boasted opaquely that “crypto is one of those things we have to do. Whether we like it or not, I have to do it.” A white paper for the new business dubbed Trump “its chief crypto advocate”, and his sons have promoted it aggressively and helped to lure new investments.

Reuters reported in late March, that World Liberty Financial had raised more than $500m in recent months. Trump’s family now controls the bulk of its business and Reuters revealed that it is entitled to about $400m in fees and 75% of revenues from WLF’s token sales.

The recent $2bn investment deal that WLF will be part of with the Abu Dhabi fund and Binance is the latest big financial coup for Trump and his sons, but one that’s raised some red flags given legal problems that have previously beset Binance.

MGX Overview

- Investor Type

- Venture Capital

- Status

- Active

- Professionals

- 5

- Investments

- 8

- Portfolio

- 7

MGX General Information

Company Description

Founded in 2024, MGX is a venture capital firm based in Abu Dhabi, United Arab Emirates. The firm seeks to invest across semiconductor, artificial intelligence infrastructure, and artificial intelligence technology sectors.

Business Details

The Abu Dhabi fund MGX , which has backing from the UAE government, according to reports is slated to use a stablecoin product that WLF is now marketing to help complete its $2bn investment deal in Binance. A stablecoin is a cryptocurrency pegged to a traditional currency, or a more stable asset such as the US dollar.

The WLF stablecoin, dubbed USD1, will be used by MGX to invest in Binance, the world’s largest cryptocurrency exchange that operates in dozens of countries; on 22 May Binance also announced that it would list WLF’s USD1 for trading.

Previous legal problems for Binance may attract new attention, say critics including congressional Democrats. Binance’s ex-CEO and founder, Changpeng Zhao, in late 2023 pleaded guilty in the US to violating the Bank Secrecy Act and failing to maintain an effective anti-money-laundering program at Binance, which also copped a guilty plea to criminal charges and paid over $4bn in fines.

Zhao, who served a four-month prison term last year and still owns 90% of the firm, revealed on a podcast on 5 May that he was seeking a pardon from the Trump administration, which several senators raised questions about in a 15 May letter to top justice department officials.

Before WLF’s role with the Abu Dhabi fund’s investment in Binance and to grow its crypto empire, WLF unveiled its first stablecoin in March, as a stablecoin Senate bill – dubbed “the Genius Act”, which critics say eases regulatory controls too much – moved closer to passing.

Trump has taken corruption and self-dealing to a new level

Former Republican congressman Dave Trott

Watchdog groups and some Democrats including Warren have warned that the Senate bill’s regulations are too lax to prevent fraudulent uses, as new studies have noted that these coins and other digital assets are increasingly being used for money laundering by Chinese exporters and producers of fentanyl and other synthetic drugs.

It's a paradox that Trump on the one hand is imposing heavy tariffs on countries such as Mexico and Canada (only 1%) of Fentanyl smuggling into the US, promotes crypto through WLF and Binance association where Chinese exporters and producers of precursors to Fentanyl are parking their monies earned through smuggling synthetic opioids into the US.

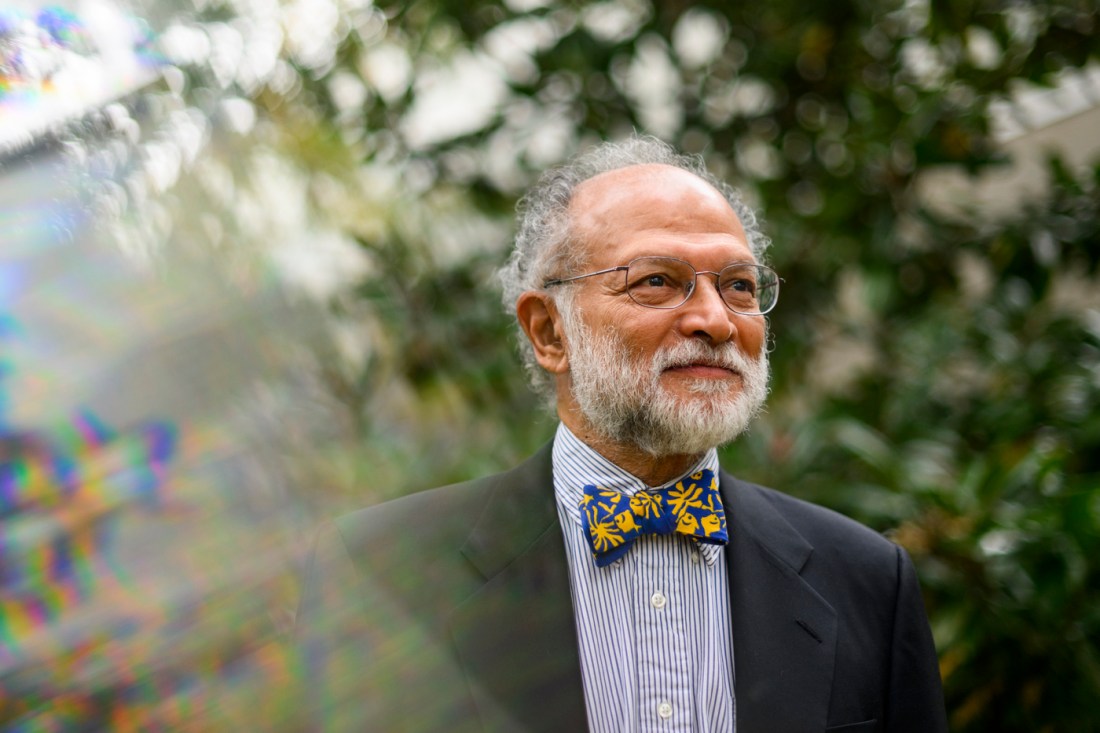

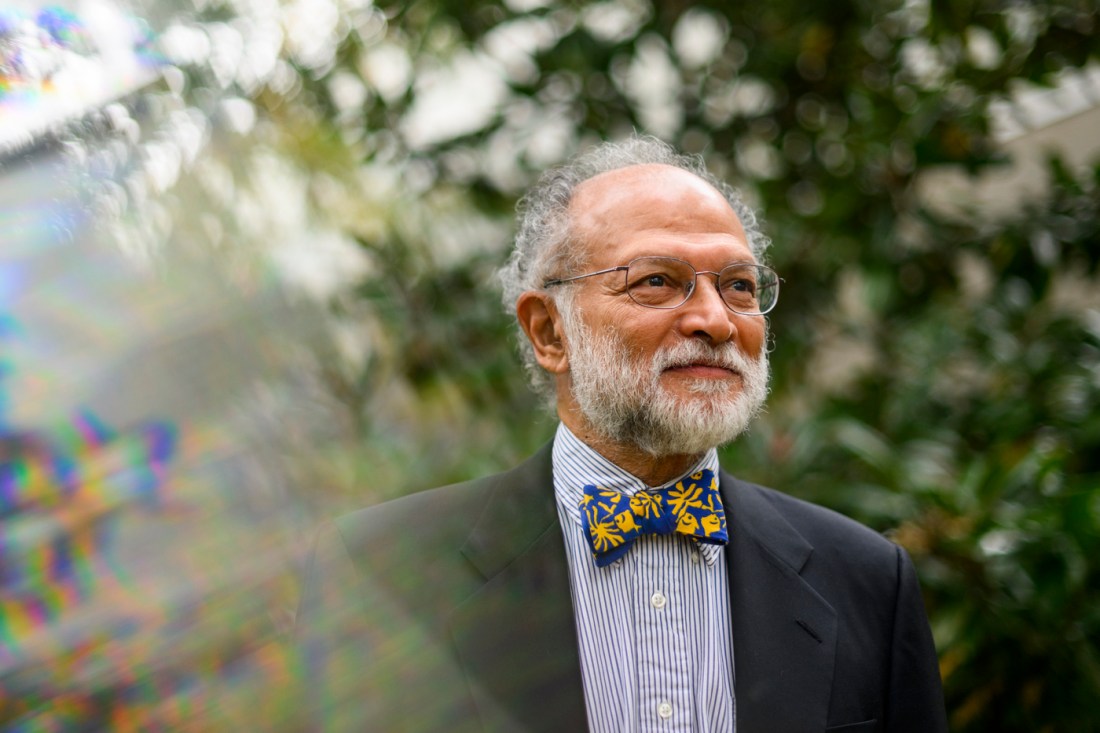

RAVI SARATHY PROFESSOR ON BIT COINS.

First of all, what are stablecoins, and why are they important for the crypto industry?

Stablecoins are part of this whole movement toward digital currencies. The point of digital currencies is that they’re very fast; they’re instantaneous; you get immediate confirmation of the transaction; they’re peer-to-peer, and if you do it in a public blockchain, there is a clear record and it’s immutable, it can’t be hacked, etcetera. We know there is huge interest in bitcoin; its market capitalization is almost a trillion dollars.

But the thing about bitcoin and Ethereum [Ether (ETH)] as digital currencies is that they’re very unstable. We’re seeing these huge fluctuations. This is where stablecoins come in. Instead of using bitcoin or Ethereum, you use something that has stable value because it is pegged to another currency. The idea is that you create an additional currency, and people can own it in their wallets, then send it from one wallet to another using private and public keys.

How do you keep a stablecoin stable?

You need reserves to back that particular coin. Say I take a billion dollars and put it into a bank in the form of bank notes or Treasury bills — something that’s very stable in value — and for each dollar that I have in reserve I issue one digital equivalent. So if I have a billion dollars in reserves, I can issue up to 1 billion stablecoins. There have been instances where stablecoins have had fairly large failures because of the lack of reserve-to-stablecoin parity, and because the reserves were not properly safeguarded or segregated. Terra (LUNA) is probably the best-known example of this.

Why are stablecoin regulations important?

This whole issue of stablecoin regulation is predicated on the value of having a stable digital currency, and how that might help the U.S. financial sector stay competitive in world markets. The subtext here is the domination of the U.S. dollar. A lot of foreign individuals and companies, particularly in countries where currencies are somewhat volatile, might want to hold U.S. dollar stablecoins. They would take their local currency, which is highly volatile and depreciating, buy stablecoins and hold them in a wallet somewhere. That way, they would have a U.S. dollar asset. Of course, the U.S. dollar is highly used in global trade: it’s a basis for denominating trade in many parts of the world.

Part of the GENIUS Act is the idea that the U.S. government and the issuers and regulators will work with other countries that are also issuing stablecoins in their currencies. The biggest one is the euro. The European Union has a regulation — the MiCA regulation — which tries to provide a clear regulatory framework for European cryptocurrencies, stablecoins and digital instruments in general. The odds are there will be some kind of regulation in place before the end of the year in the arena of stablecoin.

Are there any parts of this bill that you take issue with?

I think the issue will become how well this protects consumers. For example, you and I have deposit protection of up to $250,000. I don’t see anything of the sort in the GENIUS Act. The problem with stablecoin is you need to have a private key and a digital wallet; and if you lose the private key, you can’t access the wallet. There’s also the possibility that the digital wallet could be hacked; somebody could gain access to it and take the money out really quickly. There have been cases of people losing huge amounts of money because of wallet hacks. What are the protections available to consumers if they start using stablecoins? I don’t think the bill adequately addresses deposit protection.

More in Business

Why one out of three family businesses is inherited by the wrong person

Northeastern research finds companies with LGBTQ+ board members outperform peers

Fyre Fest is up for sale. Could someone buy the brand and turn it around?

Accounting research shows how firms can strengthen diversity among auditors

What actually happens if someone takes money out of your wallet without permission? If you’re using a public blockchain to run these stablecoin issuers, then theoretically when a transaction is done — that’s it. You would have to go after the issuer separately to try to get that money back. From a public perspective, I would say a majority of the public isn’t particularly savvy when it comes to using private keys and digital wallets. Everyone is familiar with Venmo and Zelle; but those are linked to traditional bank accounts and credit cards. Moving to a digital wallet is a little more complicated, but it does require an additional step.

A second issue would be concerns about concentration. In other words, would a few companies come to monopolize the industry? According to the bill, you could have either state-regulated stablecoin issuers, or federally-regulated issuers. State-regulated would be under $10 billion, so theoretically a small credit union or bank could issue its own stablecoin to its own customers. But if there’s 150 different stablecoins floating around, you’ll run into a problem if I have a stablecoin from my bank, and you have a different bank account, then you have to take my stablecoin and either keep it or list it on an exchange for a different coin, and there may be some transaction fees involved, which introduces friction into the market.

Another problem is: are state regulations going to be as strong as federal regulations, and who is going to enforce compliance? The bill notes a $100,000 a day fine, but in the grand scheme of things, $100,000 might not cut it when you look at the volume of cryptocurrencies and stablecoins being issued.

How many stablecoins do we want, and what will be the ease of interoperability between stablecoins issued by many different entities? Over time, what will happen is the largest issuers will end up dominating the industry. If Google or Amazon or Meta started launching their own stablecoins, the prospects of monopolies or oligopolies emerging poses a problem.

If this bill forces all stablecoin issuers to follow the same rules as banks — because remember: stablecoins can be issued by anyone — it will make it much easier for every bank in the U.S. to start launching its own stablecoins. That could be a big plus.

A stablecoin that is clearly regulated would allow for lower costs and faster transactions. Overall, I think that will be of some benefit to the consumer. If U.S. dollar stablecoin regulation allows for closer interoperability with foreign stablecoins, it should lower the cost of cross-border transactions, which would also be of benefit to both companies and people.

Republicans in Congress have been largely silent about Trump and his family capitalizing on their crypto ventures to enrich themselves. But the Wyoming Republican senator Cynthia Lummis, a lead sponsor of the Genius Act, which on 19 May notched a key vote towards Senate passage and would also benefit WLF’s stablecoin, has said the upcoming $Trump events have given her “pause”.

- The GENIUS Act aims to provide a clear regulatory framework for stablecoins, which are digital currencies designed to maintain a stable value, often pegged to a fiat currency like the U.S. dollar.

- Reserve Requirements: The bill mandates that stablecoin issuers hold reserves backing their stablecoins, ensuring that users can redeem their coins for the underlying asset.

- Consumer Protections: It includes provisions to protect consumers, such as requiring issuers to publicly disclose reserve composition and providing priority repayment to coin holders in the event of bankruptcy.

- Anti-Money Laundering Compliance: The GENIUS Act requires stablecoin issuers to comply with anti-money laundering and anti-terrorism finance laws.

- Federal Oversight: The bill establishes a federal regulatory framework for stablecoin issuers, with the option for larger issuers to be regulated under the Federal Reserve's framework or the Office of the Comptroller of the Currency.

- National Security: The GENIUS Act also aims to enhance national security by strengthening the Treasury Department's ability to monitor the stablecoin sector and combat illicit activity.

- Reserve Requirements: The bill mandates that stablecoin issuers hold reserves backing their stablecoins, ensuring that users can redeem their coins for the underlying asset.

- The GENIUS Act is expected to have a significant impact on the stablecoin market, potentially influencing the growth and development of the industry. It could also have implications for the U.S. dollar's position in the global digital economy.

Some former Republican members are livid about Trump’s crypto dealings.

“Trump has taken corruption and self-dealing to a new level,” said the ex-Republican congressman Dave Trott of Michigan. “He seems singularly motivated to deregulate the crypto industry for the financial benefit of himself and his family, and few Republicans are calling him out.”

Trott said he was weighing a run for Congress in 2026 as an independent or a Democrat. “I wish I was still in Congress so I could vote to impeach the guy,” he added, referring to Trump.

Further, leading House Democrats say Trump’s presidency is benefiting his burgeoning crypto business in dangerous ways.

“Trump’s personal and family net worth has gone up by billions of dollars this year due to crypto ventures,” said the Democratic representative Jamie Raskin from Maryland. Raskin warned that Trump’s crypto ventures offered the “perfect opportunity for foreign government, corporate and individual funds to be funneled into Donald Trump’s bank account and his family’s finances”.

Likewise, Noble foresees national security and other dangers with Trump and his family’s fast-growing crypto businesses.

“World Liberty Financial and $Trump appear to allow foreign governments, corporate interests and wealthy private donors who want something from Trump to secretly add to his wealth.

This is a roadmap for corruption. What they want in return for their investments may present real dangers to our economy and national security.” Noble observed.

Source: Multiple publications and NBC, Guardian, AP.

Comments

Post a Comment