Gold prices go through the ceiling - US and Europe hedge against inflation but cautious buying dominates - Russia hoards - India shows resilience as tradition demands gold at weddings

Gold Glitters with Record Highs in Prices

Gold prices touched near $3500 per troy ounce (Rs 297,000) on Sept 01 beating its April record demonstrating its volatility in uncertain markets as dollar weakened investors tensed hopeing rate cuts

Gold at Record Highs: What Soaring Bullion Prices Mean for Jewelry, Markets, and Geopolitics

By TN Ashok | New Delhi - INDIA -- September 1, 2025

When gold crossed $3,477 per ounce on September 1 — brushing against its April 2025 record of $3,500 — the world once again turned its gaze toward the glittering metal that has long outshone all others in times of uncertainty.

Silver, too, made headlines, breaching $40 an ounce for the first time since 2011. The bullion rally, powered by U.S. Federal Reserve rate cut bets, a weaker dollar, and investor anxiety over inflation and Fed independence, has profound consequences for markets, jewelry consumption, and geopolitics.

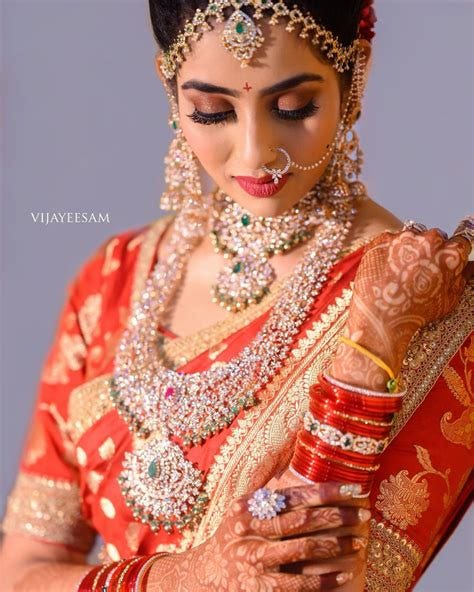

At the heart of this story is a paradox: while gold becomes ever more expensive, demand in cultural strongholds such as India — the world’s largest consumer — remains resilient, even as price-sensitive buyers face dilemmas during weddings and festivals.

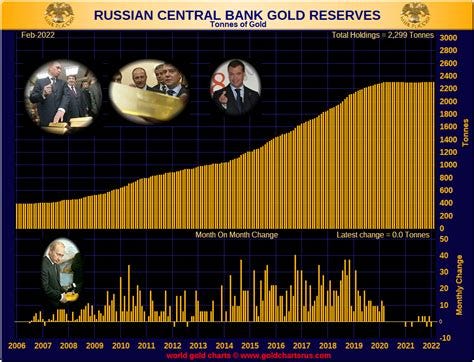

At the same time, in Russia, sanctions and distorted markets make gold relatively cheap while silver trades at a premium, creating unusual trade opportunities. The bullion boom is reshaping everything from luxury jewelry in Paris and New York to dowry traditions in Delhi and Hyderabad.

Why Gold Is Soaring — And How It Ties to Oil and Rates

Gold’s rally is not a sudden phenomenon. Since 2022, bullion has been on a steady uptrend, fueled by three factors:

U.S. Monetary Policy: With Fed Chair Jerome Powell under fire from President Trump for resisting political interference, the Federal Reserve is signaling possible rate cuts to cushion a weakening labor market. Non-yielding gold thrives in low-rate environments because the opportunity cost of holding it falls.

Geopolitical Stress: Russia’s war in Ukraine, U.S.-China tariff battles, and a fragmented global trade regime have made bullion the ultimate safe haven. Unlike currencies, gold is immune to sanctions or tariffs.

Oil-Gold Correlation: Historically, crude oil and gold prices move in tandem, as both are tied to inflation expectations. Yet in 2025, the correlation is weakening. Oil has been volatile — falling on weak demand, then rising on supply cuts — while gold has steadily climbed. Investors increasingly see gold, not oil, as the truest inflation hedge.

Jewelry in the Age of Expensive Gold

India: Weddings That Cannot Do Without Gold

India consumes over 700–800 tonnes of gold annually, nearly half of it for weddings. Despite sky-high prices — with domestic gold now above ₹6,500 per gram (22k), up nearly 20% year-on-year — demand is sticky. Indian weddings are incomplete without gold jewelry, which symbolizes prosperity and security.

Middle-Class Pressure: Families are cutting down on the weight of ornaments but not the sentiment. Lighter pieces, hollow jewelry, and gold-plated alternatives are seeing demand.

Urban Shift: Millennials in Mumbai and Bengaluru are experimenting with diamond-and-gemstone blends, but rural India remains devoted to pure gold.

Festivals: The upcoming Diwali season is expected to test consumer resilience. Traders expect pent-up demand despite sticker shock.

United States and Europe: Luxury Under Pressure

In the U.S. and Europe, jewelry demand is more discretionary. Here, higher gold prices squeeze margins for brands like Tiffany, Cartier, and Bvlgari, which must balance between passing costs to customers and diluting margins.

Luxury Resilience: Wealthy buyers in Paris or New York still purchase gold ornaments as status symbols, but the middle market is shifting toward silver and platinum.

Fashion vs. Investment: Unlike in India, where jewelry doubles as savings, in the West, jewelry is lifestyle-driven. Rising prices risk reducing volume sales, though high-net-worth demand for statement pieces continues.

Russia: Cheap Gold, Expensive Silver

Sanctions have distorted Russia’s bullion market. While Moscow has promoted domestic consumption and gold remains relatively cheap due to limited export options, silver has become unusually costly.

Gold Market: Russia has been forced to stockpile reserves, and local jewelers benefit from access to gold at discounted prices compared to world markets.

Silver Market: Industrial use, combined with constrained imports, has made silver dearer, with prices well above international averages.

Global Arbitrage: Traders from neighboring countries and even the Middle East are quietly eyeing Russia as a silver export source while snapping up gold bargains.

Is Gold Scarce? Artificial or Natural Shortage?

A critical question lingers: is the rally driven by true scarcity or by financial engineering?

Mining Challenges: Global gold mine output has plateaued. Major discoveries have declined, and extraction costs are rising in places like South Africa and Australia. Environmental regulations make new mines harder to develop.

Artificial Tightening: Central banks and ETFs are stockpiling bullion, reducing market liquidity. China and India’s central banks have been net buyers, while Russia has hoarded reserves.

Silver’s Parallel Story: Silver supply is also tightening, but its industrial demand — in solar panels, electronics, and EVs — adds to the squeeze. Hence its surge to a 14-year high.

Tariffs, Sanctions, and the Global Gold Trade

The U.S. tariffs war under Trump adds another layer of complexity. With China threatened by 200% tariffs, Russia sanctioned, and India slapped with 50% duties, the Shanghai Cooperation Organisation (SCO) bloc has begun exploring gold-backed trade settlements.

India’s Defiance: By continuing to import gold despite U.S. displeasure, India signals its economic sovereignty.

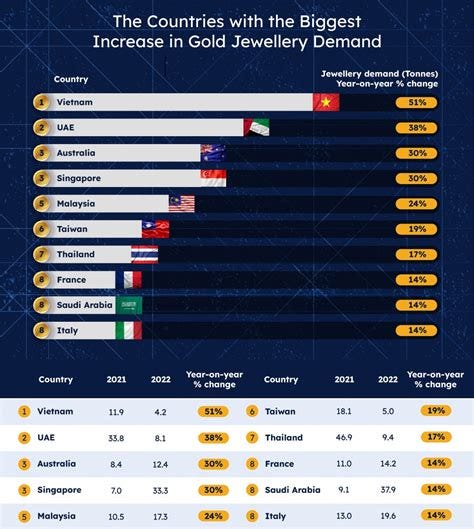

Middle East Dynamics: Gulf states, particularly the UAE, act as bullion hubs, re-routing Russian and African gold into global markets. Dubai’s souks are thriving despite Western scrutiny.

Europe’s Position: With inflation still stubborn, Europeans are flocking to gold ETFs, even as jewelers worry about shrinking sales volumes.

What It Means for Consumers and Investors

In India: Weddings will keep gold demand strong, though smaller ornaments may become the norm. Rural households may switch to silver, especially as prices remain lower relative to gold.

In the U.S./Europe: Expect jewelry brands to innovate with alloys, gemstones, and lab-grown diamonds as gold becomes too costly for mass buyers. Investment in ETFs and coins will rise.

In Russia: Consumers enjoy gold at a relative discount but pay dearly for silver. Arbitrage opportunities could create parallel markets.

Conclusion: A World Remade by Bullion

Gold’s surge is not just about price charts. It reflects a deeper reordering of global economics and politics. As Fed policy tilts dovish, as Trump’s tariff war distorts trade, and as sanctions reshape commodity flows, bullion becomes the ultimate neutral asset.

For India, gold remains tradition, resilience, and defiance rolled into one. For the U.S. and Europe, it is an inflation hedge and luxury headache. For Russia, it is both a lifeline and a distortion. And for the world at large, it is a reminder that in an era of fiat turmoil, digital fragility, and geopolitical flux, some things remain timeless.

As one bullion dealer in Mumbai put it: “Governments can print money, but they cannot print gold. That is why no wedding, no crisis, and no new world order is complete without it.”

India must unload its massive private gold holding to propel the country into greater heights. India's private gold holdings are valued at approximately $2.4 trillion, according to the World Gold Council (WGC), which estimates these holdings at around 25,000 tonnes.

ReplyDelete