A Congressional (parlimentary) committee nails MNC pharmas on price gouging - Modi's government is moving towards pharmas to spread their balance sheets to itemise expenditure - Argument that it takes billions to develop a drug over 10-15 year time lines was destroyed during the pandemic

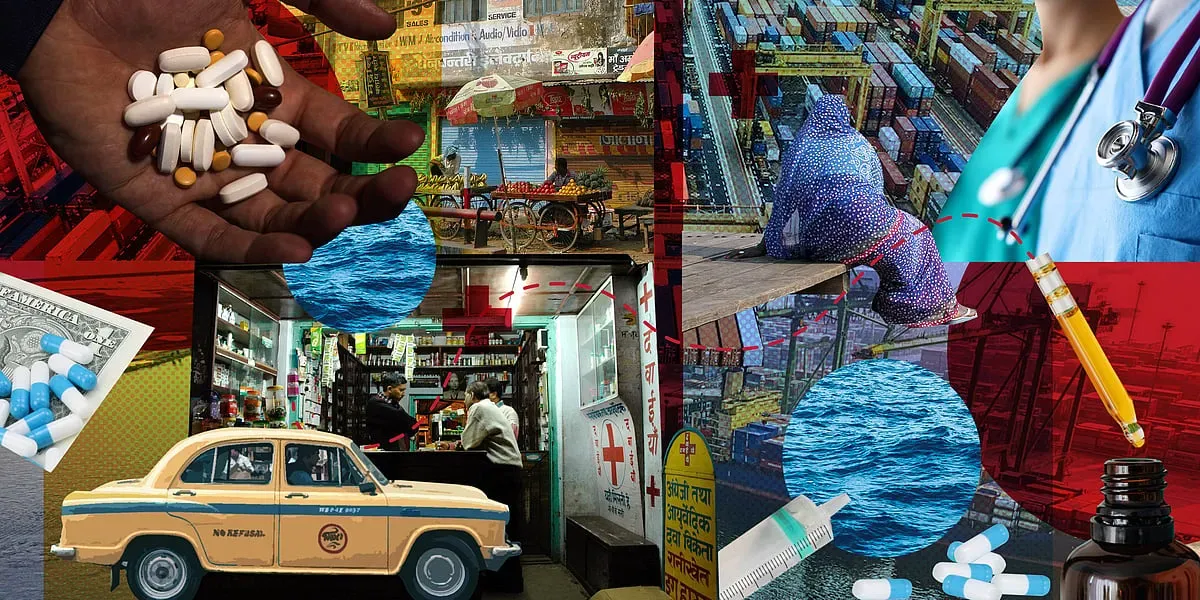

India's Pharma Revolt: How Delhi's Pricing Crackdown Could Upend the Global Drug Industry

Parliamentary report exposes thousand-percent markups on decades-old medicines, forcing Modi government to act—and sending tremors through boardrooms from Basel to Boston

Parliamentary report exposes thousand-percent markups on decades-old medicines, forcing Modi government to act—and sending tremors through boardrooms from Basel to Boston

NEW DELHI — In a windowless committee room on Parliament Street, Indian lawmakers have lit a fuse that threatens to detonate the business model of the world's most profitable industry.

The numbers are stark, even obscene. A common allergy pill that costs distributors two cents to procure sells on pharmacy shelves for 25 cents—a markup exceeding 1,100 percent. A calcium supplement with a wholesale cost of 20 cents retails at nearly four dollars. A heartburn medication that costs pennies commands more than two dollars at the counter.

These figures, buried in a scorching parliamentary committee report released this month, do more than expose pricing abuse in the world's largest democracy. They pull back the curtain on a global system of engineered inflation that has operated for decades with impunity across continents—and they suggest that system's days may finally be numbered.

The implications are seismic. India manufactures nearly 40 percent of the world's generic medicines and 70 percent of the World Health Organization's essential drugs. If Prime Minister Narendra Modi's government follows through on the committee's recommendations—and senior officials now say it will—the regulatory earthquake could crack foundations from Manhattan to Munich, triggering price collapses that no amount of lobbying can contain.

"This isn't just about India anymore," said a senior adviser to the National Pharmaceutical Pricing Authority who spoke on condition of anonymity because deliberations remain confidential. "When you control the world's pharmacy and you decide to stop playing the pricing game, everyone else has to adjust their expectations."

The Paradox Laid Bare

What makes the parliamentary report devastating is not complexity but clarity. For years, multinational pharmaceutical executives have defended eye-watering prices by invoking research costs, regulatory burdens, and innovation timelines. Those arguments evaporate when applied to the drugs India's committee examined.

These are not cutting-edge therapies. They are decades-old molecules whose patents expired long ago, whose formulas are public knowledge, whose clinical trials were paid for generations past. Yet they command markups that would trigger federal investigations in any other industry—anywhere from 600 percent to an astonishing 1,900 percent above cost.

The committee's conclusion is withering: these prices have nothing to do with science or innovation. They reflect pure market power, exploited through regulatory loopholes and an insurance infrastructure designed to hide true costs from patients until medical bills trigger bankruptcy.

In India, where more than 60 percent of healthcare spending comes directly from patients' pockets, those markups don't just strain family budgets. They kill.

The report documents cases of patients forgoing treatment, splitting pills to stretch prescriptions, and purchasing counterfeit drugs from black markets because branded versions—identical in chemical composition to their generic counterparts—cost five to ten times more.

"They're not charging for innovation," said Dr. Kavita Sharma, a public health researcher at the Centre for Policy Research in New Delhi. "They're charging for the privilege of not dying. And they've gotten away with it because nobody had the political will to publish the real numbers."

Until now.

Modi Acts—and the Industry Panics

Within days of the report's release, the Modi government signaled it would not let this moment pass. Officials at the Central Drugs Standard Control Organisation, India's equivalent of the FDA, have begun drafting new regulations that would fundamentally rewrite the rules.

The proposed changes are surgical and severe:

Mandatory cost-sheet disclosure for all new drug applications, revealing manufacturing, distribution, and markup structures before market entry. Companies that refuse to submit data will be denied approval.

Revival and expansion of Trade Margin Rationalization, capping the total markup across the supply chain at no more than 30 percent above manufacturing cost for essential medicines—a ceiling that would obliterate current practices.

Empowerment of the National Pharmaceutical Pricing Authority to reject price applications deemed "exploitative," with authority to impose fines equivalent to 200 percent of illegal profits and revoke marketing licenses for repeat offenders.

Mandatory generic substitution at pharmacies unless doctors explicitly certify medical necessity for branded versions, ending the cozy relationships between pharmaceutical sales representatives and prescribing physicians.

The measures amount to the most aggressive assertion of state power over drug pricing in a major economy since the 1960s. And because India is not just a market but the engine room of global pharmaceutical manufacturing, compliance is not optional.

"If you want to operate in India, you play by India's rules," said a senior official at the Ministry of Chemicals and Fertilizers. "And if you don't like it, good luck finding another country that can produce at our scale and cost."

That threat is not empty. India's pharmaceutical sector supplies critical ingredients and finished drugs to nearly every country on earth. When COVID-19 shuttered Chinese factories, it was Indian manufacturers who kept global supply chains functioning. Any multinational that tries to retaliate by pulling out of India risks losing access to the very production capacity that makes its business model viable.

The Global Domino Effect

Pharmaceutical executives in Basel, London, and New Jersey are now gaming out scenarios that were unthinkable six months ago. If India imposes transparency requirements and margin caps, how long before other governments demand the same?

Already, there are signs of contagion. Lawmakers in Brazil and South Africa have requested copies of the Indian report. European regulators are quietly asking whether their own drug pricing oversight has been too lenient. In Washington, progressive Democrats are citing the Indian findings to demand hearings on why Americans pay more for insulin and cancer drugs than patients anywhere else.

"India just gave every government on earth a roadmap and a justification," said Professor Ellen 't Hoen, a medicines policy expert who has advised the WHO. "They've shown that transparency doesn't destroy pharmaceutical companies—it just destroys pharmaceutical profits. And that's a distinction governments are suddenly willing to make."

The industry's nightmare scenario is becoming plausible: a cascade of price controls and disclosure mandates spreading from Delhi to Brasília, from Johannesburg to Jakarta, eroding margins in every market except the United States. And even American prices may not hold if other countries demand most-favored-nation clauses linking their costs to India's.

The Vaccine Crisis That Changed Everything

The pharmaceutical industry's traditional defense—that high prices fund future innovation—suffered catastrophic damage during COVID-19. The vaccines that saved millions of lives were developed in under a year, obliterating the claim that decade-long timelines are scientifically necessary.

Moreover, much of the core technology came not from Big Pharma but from academic labs and small biotech firms funded by governments. Pfizer and Moderna reaped more than $60 billion in revenue, yet neither company invented the lipid nanoparticles that made mRNA delivery possible. Those came from researchers in Vancouver and Philadelphia, some of whom are still fighting in court for credit and compensation.

The pandemic laid bare an uncomfortable truth: the pharmaceutical industry is extraordinarily good at manufacturing and marketing, but much of its innovation comes from publicly funded research that companies then monetize at monopoly prices.

Pfizer Enters into Agreement with Acuitas Therapeutics for Lipid Nanoparticle Delivery System for Use in mRNA Vaccines and Therapeutics

India's report makes that argument explicit. It notes that many of the drugs under examination were developed decades ago with government grants, tested in publicly funded trials, and brought to market with regulatory assistance—yet patients are still being charged as if companies bore all the risk themselves.

"The social contract is broken," said one committee member who spoke anonymously. "We gave them patent protection, tax breaks, and regulatory deference because they promised affordable medicines. They broke that promise. Now we're taking back control."

The Coming Storm

The changes India is contemplating will not happen overnight. Pharmaceutical lobbying is among the most sophisticated and well-funded in the world, and multinationals have already begun mobilizing opposition through industry associations and diplomatic channels.

But this time feels different. The Modi government, facing elections and under pressure to demonstrate economic nationalism, sees an opportunity to claim credit for making healthcare affordable without directly confronting Western governments. For once, political incentives align with public health imperatives.

If India moves forward—and officials insist it will—the consequences will reverberate for years. Drug prices in the Middle East, Africa, and Latin America, which often peg to Indian benchmarks, would plummet. European health systems could demand renegotiation of procurement contracts. Australian and Canadian regulators might impose similar disclosure requirements.

Even in the United States, where pharmaceutical companies wield enormous political power, pressure would intensify. How long can American patients be asked to subsidize global drug development when India has proven that transparency and affordability are not mutually exclusive?

The pharmaceutical industry has survived scandals, lawsuits, and regulatory crackdowns before. But it has never faced a supplier revolt—and that is what India's parliamentary report represents.

For decades, multinational companies assumed that countries dependent on their products would never dare to regulate them aggressively. India just proved that assumption wrong.

The world is watching. And for an industry built on opacity, sunlight may prove the most dangerous disinfectant of all.

Comments

Post a Comment